Looking for Property for Sale in Haridwar May Cause Peace and Increased Happiness.

Haridwar, a city nestled in the lap of the Himalayas, holds a sacred place in Hinduism, attracting millions of pilgrims and tourists every year. It’s not just a city; it’s a spiritual journey waiting to be embraced.

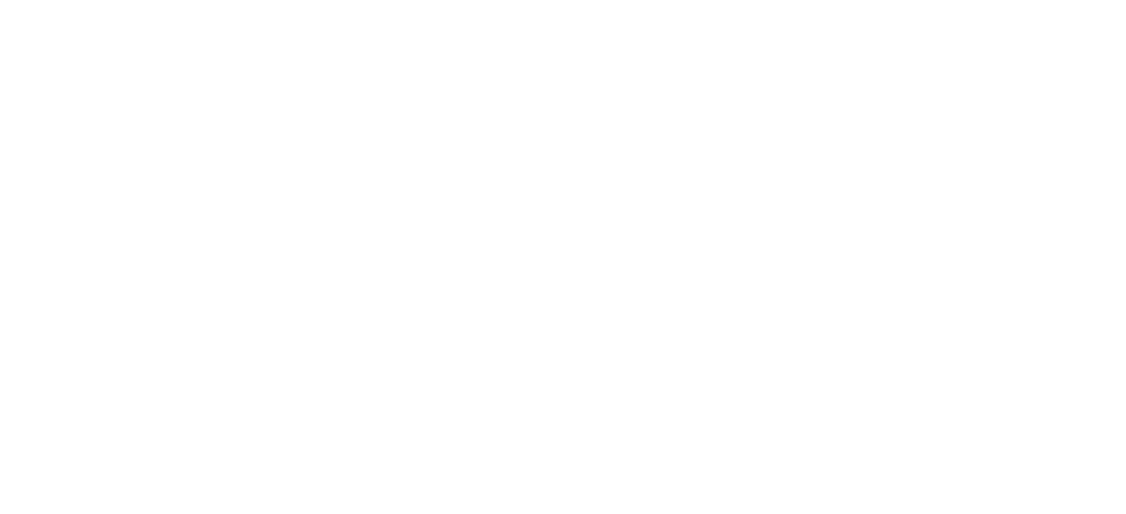

With the holy Ganges flowing through its heart, Haridwar boasts a serene ambiance complemented by the majestic views of the Himalayas, creating an atmosphere that resonates with tranquility and divinity.

In Haridwar, you’ll find a diverse range of properties, from modern apartments to luxurious villas and plots offering endless possibilities for investment and living.

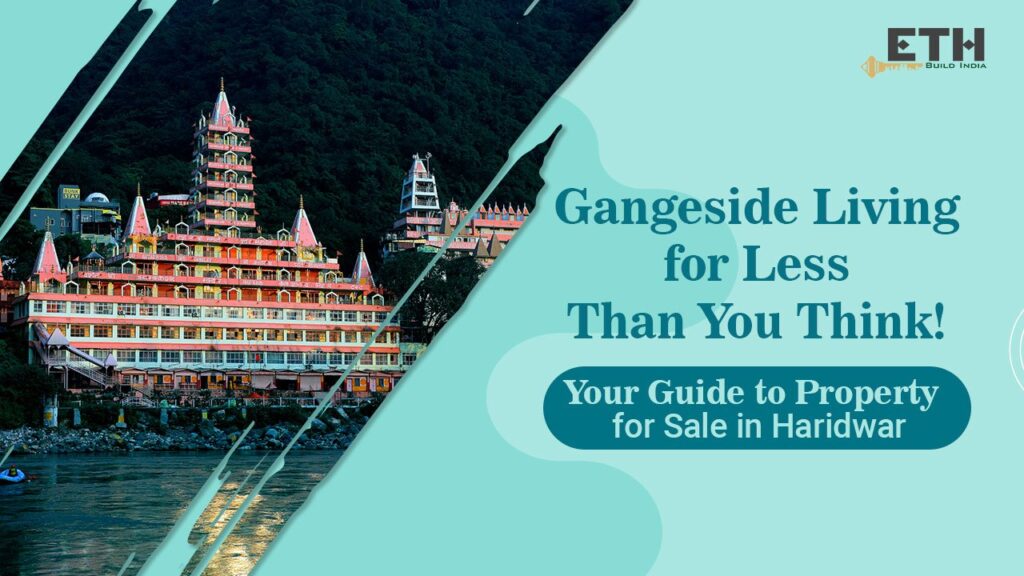

Investing in property for sale in Haridwar is not just about securing a home; it’s about investing in a lifestyle enriched with spirituality, peace, and the promise of lucrative returns. From a booming real estate market to the proximity to revered religious sites, the benefits are plentiful.

Why Buy Property in Haridwar?

Spiritual Significance

Haridwar holds immense importance in Hindu mythology, being one of the seven holiest places in India. With revered sites like Mansa Devi Temple and Har Ki Pauri, it’s a place where spirituality meets devotion. And let’s not forget the grandeur of the Kumbh Mela, a spectacle that attracts pilgrims from around the globe.

Scenic Beauty

Imagine waking up to the sight of snow-capped peaks and the melodious flow of the Ganges. That’s the everyday reality for those living in Haridwar. The pristine beauty of its surroundings rejuvenates the soul and offers a retreat from the chaos of urban life.

Peaceful Living

In Haridwar, every moment is a meditation. The tranquil atmosphere, coupled with the spiritual vibes, creates a conducive environment for peaceful living. Whether you’re seeking solace or a break from the hustle and bustle, Haridwar has it all.

Connectivity and Infrastructure

Haridwar isn’t just a spiritual haven; it’s also a well-connected city with excellent transportation facilities. With robust road and rail networks, getting in and out of the city is a breeze. Moreover, the city’s social infrastructure, including top-notch schools and hospitals, ensures a comfortable lifestyle for residents.

Investment Potential

The property market in Haridwar is witnessing unprecedented growth, thanks to its increasing popularity among tourists and investors alike. Whether it’s for rental income or long-term appreciation, investing in property for sale in Haridwar promises handsome returns.

Types of Properties Available in Haridwar

Apartments

From cozy studios to lavish 2 BHKs, Haridwar offers a plethora of apartment options to suit every lifestyle. With amenities like gyms and swimming pools, apartment living in Haridwar is both convenient and luxurious.

Villas

For those craving privacy and space, villas in Haridwar are the epitome of luxury living. With independent setups and customizable interiors, these villas offer a lifestyle that’s truly exclusive.

Plots

If you dream of building your own abode amidst nature’s bounty, Haridwar has ample plots waiting to be transformed into your dream home. With gated communities offering security and amenities, investing in plots here is a wise choice for the future.

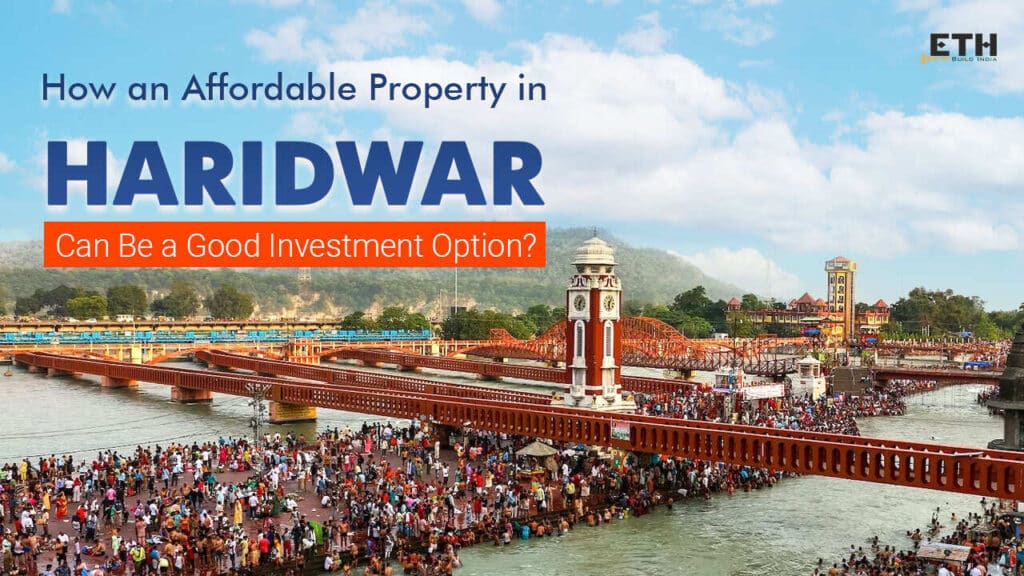

Factors to Consider When Buying Property in Haridwar

Budget

Before diving into the real estate market, it’s essential to have a clear budget in mind. Whether you’re looking for a budget-friendly apartment or a lavish villa, Haridwar offers options for every pocket.

Connectivity

Proximity to essential services and transportation hubs is crucial when choosing a property. Ensure that your chosen location offers easy access to schools, markets, and medical facilities.

Amenities

Don’t compromise on the amenities that matter to you. Whether it’s round-the-clock security or power backup, ensure that your chosen property fulfills all your requirements.

Legality

Last but not least, always verify the legality of the property with the help of a legal expert. Ensure that all documents are in order to avoid any future hassles.

Conclusion

Investing in property for sale in Haridwar is not just a financial decision; it’s a lifestyle choice. From its spiritual significance to its scenic beauty, Haridwar offers a life enriched with tranquility and divinity.

Explore the myriad property options available in Haridwar and embark on a journey to find your dream home.

Ethinfra Pvt. Ltd. presents a range of family-friendly properties in Haridwar, designed to cater to your every need. With breathtaking views of the Ganges and top-notch amenities, these properties redefine luxurious living.

Take the first step towards your dream life in Haridwar. Contact Ethinfra Pvt. Ltd. today for more information and to book a viewing.

Q: Can I customize properties like villas or plots in Haridwar?

A: Yes, villas and plots in Haridwar offer opportunities for customization according to your preferences, allowing you to create your dream home amidst the serene surroundings.

Q: Are there legal considerations when buying property in Haridwar?

A: Yes, it’s essential to ensure proper documentation and legal clearances when purchasing property in Haridwar. Consulting a legal expert can help navigate this process smoothly.

Q: What amenities can I expect with properties for sale in Haridwar?

A: Properties in Haridwar often come with amenities such as security, power backup, parking facilities, and access to recreational features like gyms and swimming pools.

Q: Why invest in property for sale in Haridwar?

A: Investing in Haridwar offers a blend of spiritual significance, scenic beauty, and promising returns due to its growing real estate market.

Q: What types of properties are available for sale in Haridwar?

A: Haridwar offers a variety of properties including apartments, villas, and plots, catering to diverse preferences and budgets.